Raising Hell: Issue 13: Debt Printer Goes Brrr

"You are like a journalistic Nero fiddling while Rome burns and having a hell of a good time [...] And you forget, you forget it is really burning," - I.F. Stone, US Journalist, 3 April 2009

It would have been impossible to script. Last Tuesday, my book tracking how Australians became some of the most indebted people on earth hit shelves. On Wednesday, S&P — the hired geeks who study debt markets and sell their conclusions to bigwigs in finance and the public service — put out a press release saying at this rate people would start going bust on their mortgages by February 2021. By Thursday morning the country was officially in recession and Paul Keating was thundering away on the tele.

While it was hard to know what era we were living in, it was the symbolism of these events that felt significant. All through researching Just Money, it was clear the situation in Australia had been building to something for quite a while. After all, we had consciously built the Australian economy as a pyramid of credit that carried with it an underlying fragility. Since our own financial circumstances are connected to everyone else’s, were something big enough to go wrong, we’d all feel it.

And then came the pandemic.

At least now it is clear I’m not the only one who has been thinking about such things. Two weeks ago the Reserve Bank of Australia released a paper titled, word for word: “How Risky is Australian Household Debt?”

It found:

“Our model cannot account for the increase in debt over the past four or five years. In addition, we demonstrate that a large but plausible fall in asset prices could lead to a substantial fall in consumption and that the increase in indebtedness over the past decade has slightly increased the potential loss of consumption during periods of financial stress.”

To summarise: the RBA was confused. Like the scientist who finds a signal before the aliens come to blow up the Empire State building, all the knowledge they had gathered from the last thirty years couldn’t explain what had happened in the last five. The advent of neoliberal capitalism in the eighties tracked with a growth in debt. Australia had high wages, which meant it could sustain higher debt loads. So far, so good. But over the last decade or so, things had gone weird. The RBA could not say why with any confidence. All they knew for sure is that people were working just to keep up with their repayment schedules and that wasn’t a good thing for an economy driven by consumer spending.

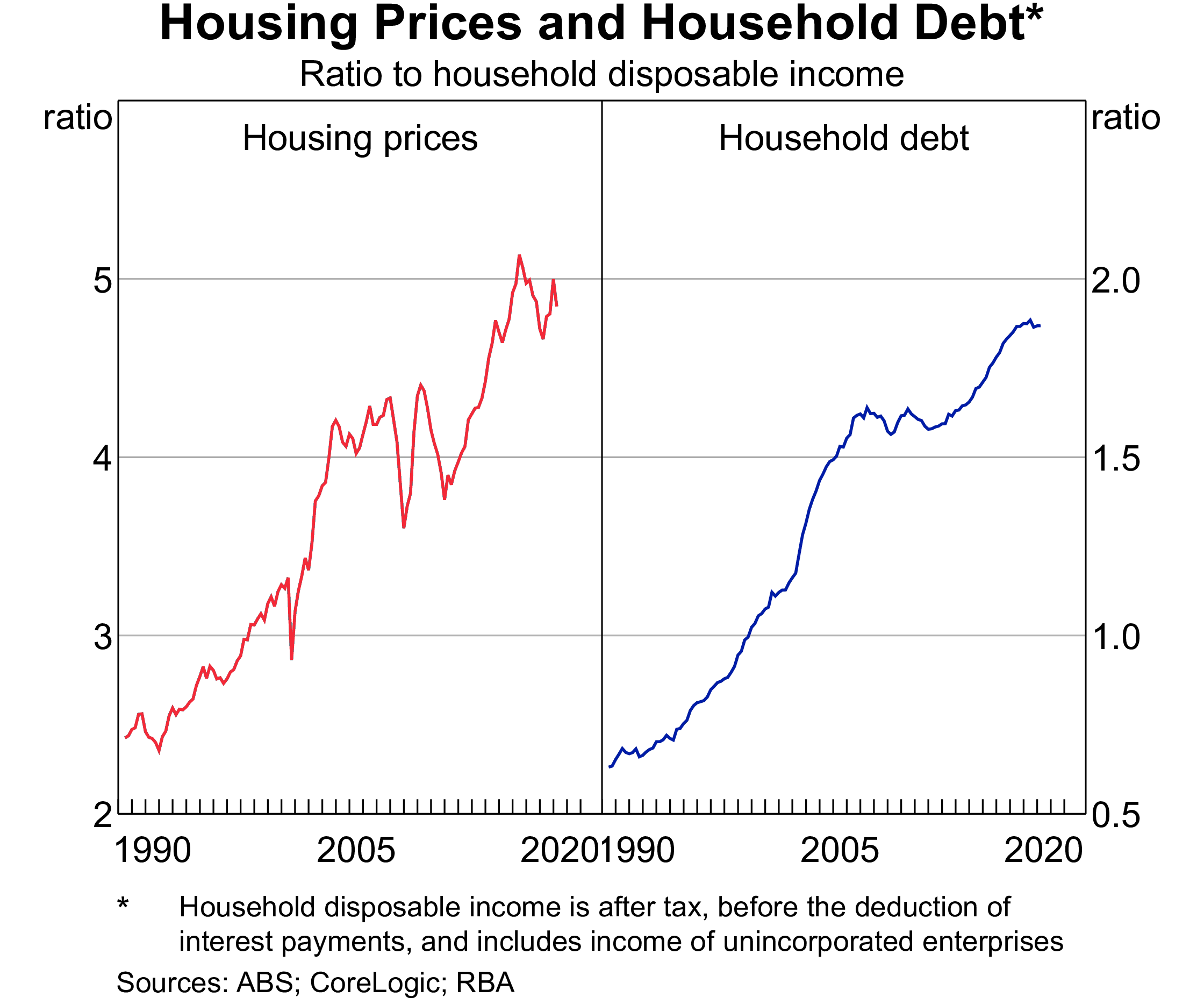

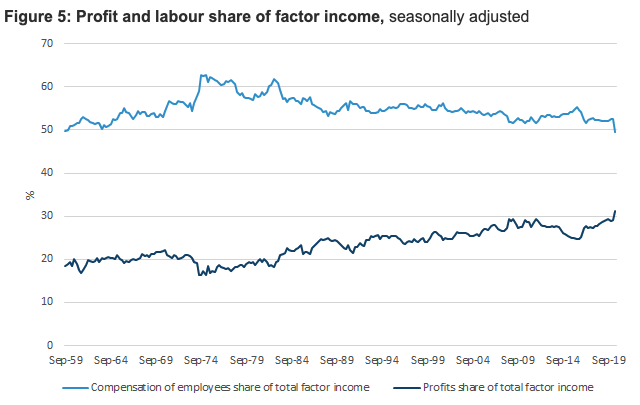

What you might call a clue to how we got here lies in the housing market. If you need a visual reference for how that stacks up, look at this other graph from the RBA:

Beyond avocado toast and Boomer bashing, the housing business is really a debt business. Mortgage backed securities — the same financial mechanisms that featured in The Big Short and blew up the world economy in 2008 — remain a multi-billion dollar business in Australia. If you think of your homeloan as an obligation you owe to your lender, you’d probably be wrong. In reality, the payments you’re making are in all likelihood going to some guy sitting in an office tower in New York who plans to on-sell it as a bluechip asset in an appropriately diversified investment portfolio.

This means two things: first, that guy has friends and they all want to buy Australian debt as an investment. This in turn translates into a raw hunger for new Australian debts — a demand we have so far been happy to meet. Credit has been made super-cheap and super-easy to access, while the houses that underpin them are being built as quickly as possible to keep new debts being minted.

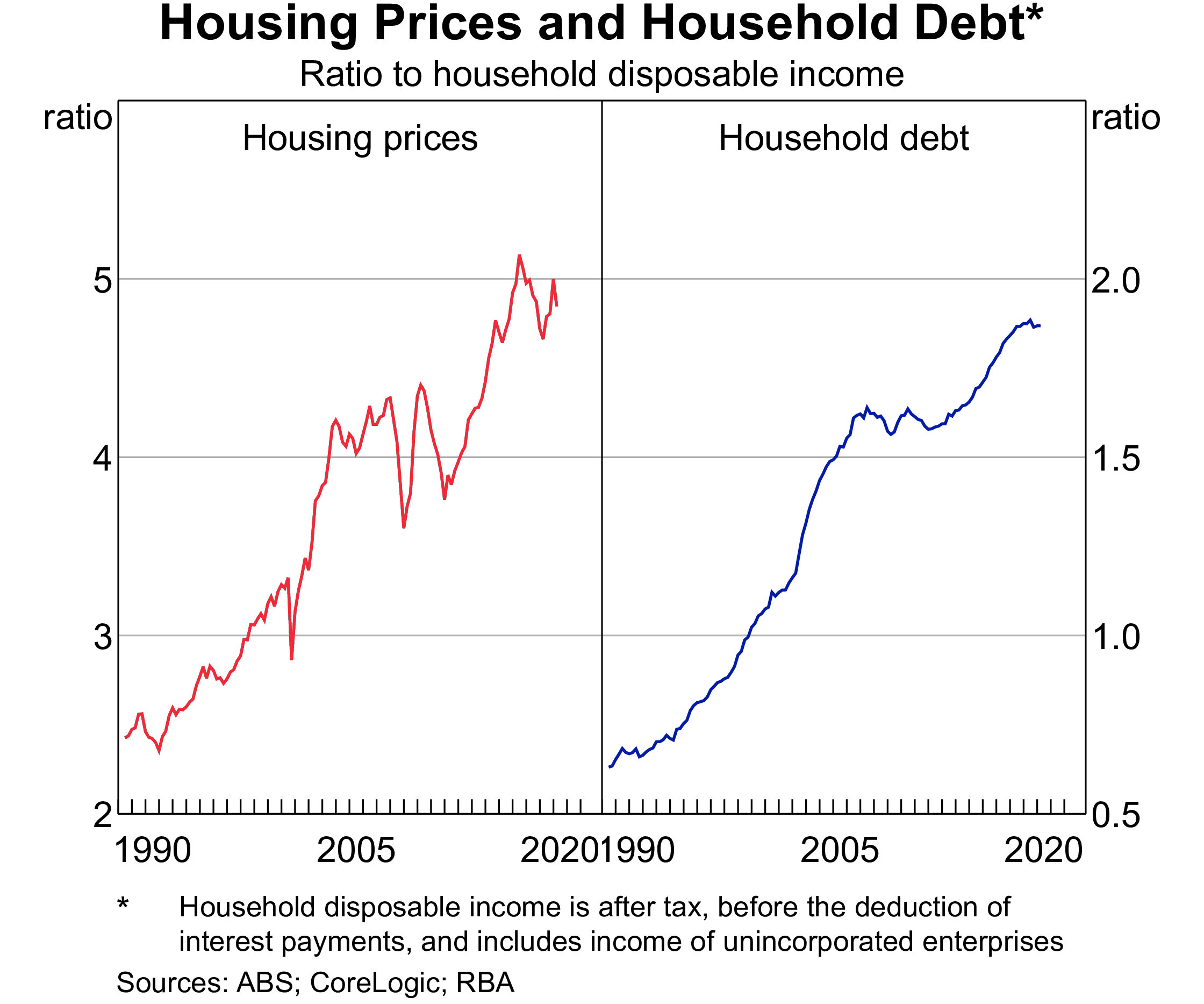

The second thing is that you can’t eat bricks and mortar. Unless you own it outright, a million dollar home translates to a million dollar debt. Throw in a car payment, a credit card bill and a HECS debt for fun, and you might reasonably conclude the average person’s ability to spend — at some point — will start to run thin. This is especially so when wages are stagnant and you end up with a society that can be represented like this:

Image: Image stolen from Ryan Batchelor (Source).

To lift a metaphor from political economist Mark Blyth, think about the Australian economy like a tricked out Commodore: it goes really fast in one direction, but it has no airbags, no crumple zones or any other safety measures. Everything is fine, until you need to corner and at that point it starts to feel like maybe you shouldn’t have been laughing at all those Volvo drivers. What this means is that, if enough Australians ever need to stop work all at once, those payments are going to stop being made and we are going to end up in trouble.

None of this is new, by the way. Deutsche Bank may have been pointing to the Australian housing market as a risk to the global economy as early as January 2019 — but these warnings have always been greeted with a shrug and a “she’ll be right”. When the credit analysts at S&P looked at it last Tuesday, they ended up saying something similar. Different regions of the country will struggle more than others, but in their view it would mostly blow over they said, declaring: “The Australian RMBS sector's relatively modest loan-to-value ratio profile will help to minimize losses in the event of borrower default, however.”

Presumably this is because if we were ever in real trouble, these guys know the nation’s political leadership would print money to bail out lenders at the earliest opportunity, thus buying enough time for the rich to liquidate their assets which — and I hate to be a total killjoy here — we’re kind of already doing.

Reporting In

Where I recap what I’ve been doing this last fortnight so you know I’m not just using your money to stimulate the local economy …

‘It's everywhere': the foreign students exposing Australia's wage theft epidemic’ (The Guardian, 2020).

It’s one thing to know the country is built on the backs of migrant workers and international students who pick our crops and cook our food, it is another thing to it in action. Story complete with secret video footage.

‘Enormous opportunity': how Australia could become the Saudi Arabia of renewable energy’ (The Guardian, 2020).

This long feature formed the last in The Guardian’s Green Recovery series and comes with gorgeous photos by David Dare Parker. As much as it is about a renewable hydrogen export project way over in Kalbarri, WA, there is a subtext to it. The transition to a zero carbon economy needs to be just and inclusive. This is possible and as a nation, Australia’s future could be really great — we just have to want it.

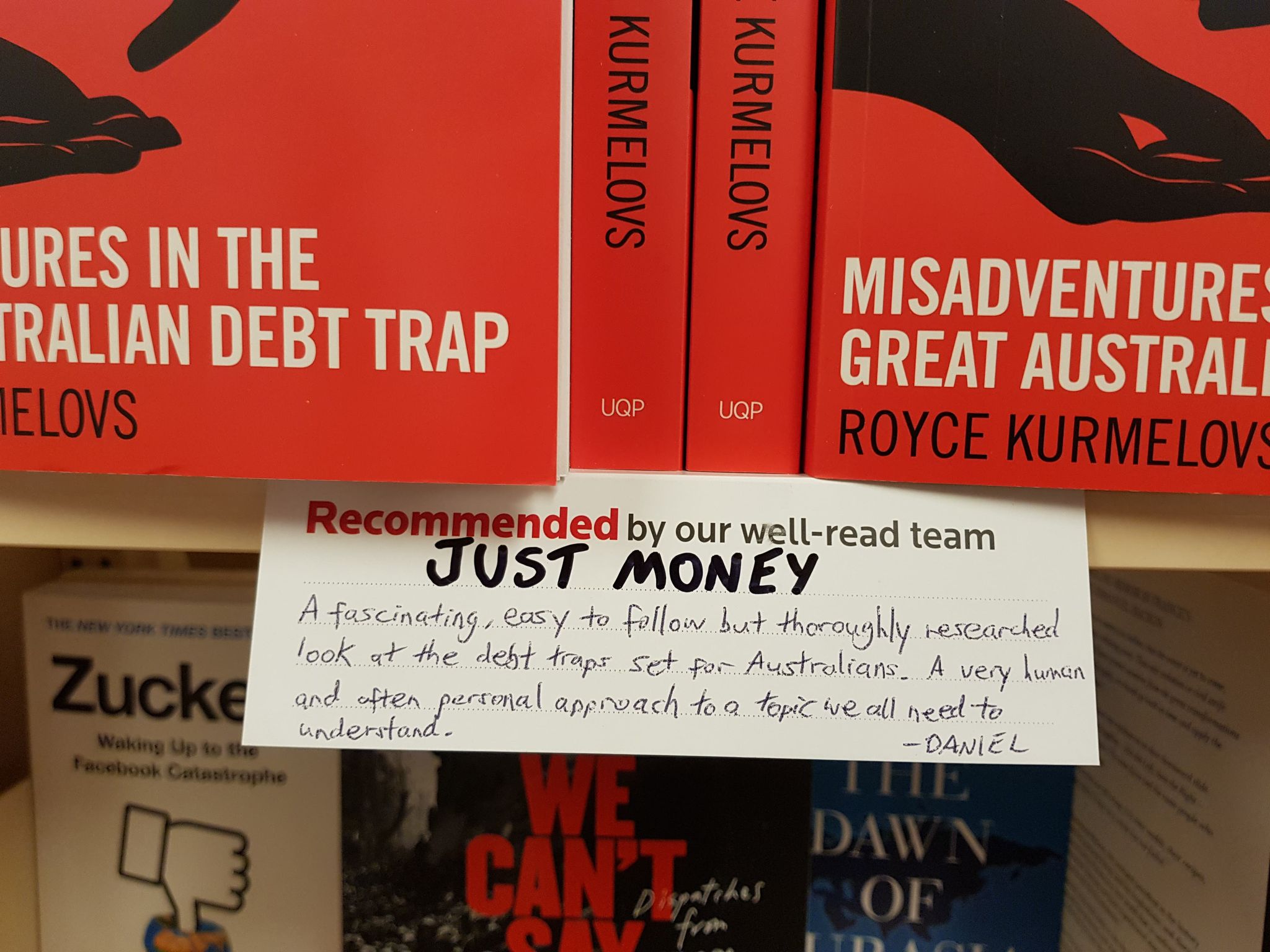

Just Money (UQP, 2020)

And of course I just released a book (on debt, in time for a national recession)!

Naturally this means I’ve spent the last week doing a bunch of media. So far I’ve been on The Drum, had this amazing review in The Saturday Paper, become the subject of another ABC story and had an extract published in VICE. This has in turn led to weird anomalies in the timeline:

If you want to get hold of a copy (do, it’s a great read), you can pick it up from places like:

South Australia

Imprints (Adelaide)

Dillons (Norwood)

Dymocks Rundle Mall (Adelaide)

Mostly Books (Mitcham)

QBE (Elizabeth, TTP and Colonnades)

Interstate:

Better Read Than Dead (Newtown)

Avid Reader (Brisbane)

Boffins Books (Perth)

Dymocks (National)

Save The Date(s)!

And because I know you love a party, I’m planning a couple:

16 September 2020 — Zoom — Avid Reader — Brisbane — 6.30PM (AEST)

Where Asher Wolf will grill me about the book and presumably robodebt. Register here.

28 September 2020 — Zoom — Better Read Than Dead — Sydney — 6.30PM (AEST)

Where Greg Jericho will also grill me about the book. Register here.

7 October 2020 — Zoom — Imprints — Adelaide — 6.30PM

Where playwright Ben Brooker will grill me on how we think about debt. Save the date.

10 October 2020 — In Person — Dymocks Rundle Mall — Adelaide — 6PM (ACST)

A party! And in this day and age. Hosted by Ben Stubbs, author of Ticket to Paradise (2020), we’ll chat for half an hour or so, then drink. Strictly RSVP due to the apocalypse. Register here.

You Hate To See It

A dyspeptic, snark-ridden and highly ironic round-up of the news from our shared hellscape…

We’re Official!

Good news, everybody: we’re officially in recession — the first one in nearly three decades. The only industry to grow over the last six months? Why the finance and insurance business, of course!

Of Lifters And Leaners

If that makes you worried, fear not! The Coalition government has been busy handing out $500 million to the murky private sector operations who have successfully financialised the state of unemployment. At a time when the government is winding back economic support for the average Josephine, internal documents dug up by Rick Morton at The Saturday Paper show the notoriously corrupt Jobactive sector — that feeds off misery — is being given a handout for doing nothing.

Time Really Is A Flat Circle

Last Wednesday VICE reported Amazon was hiring its very own modern-day Pinkertons to monitor union activity within the trillion-dollar company. As Jacobin pointed out, none of this is particularly new. Big private companies — both in Australia and abroad — have long relied on private cops, spies and militias — sometimes even hiring in the armed forces of the entire US government. The only real question is: how long until someone makes an app for this too?

Good Enough For Government Work

South Australia’s Transport Department has brought in a crack team of corporate execs on million-dollar salaries to help them out with things like procurement. So what, you say? Turns out these guys are working from home through the pandemic. Again, what about it? Well, they all live in Sydney — a parochial sin that plunged the former South Australia Labor government into a world of trouble. It is also perhaps even worse for the current government given Liberal Premier Steven Marshall literally campaigned on a platform of “restoring state pride and confidence” while promising to end the brain-drain. Then again, this is also a government that is trying to blunt the state’s anti-corruption cops, so...

But You Know What They Say?

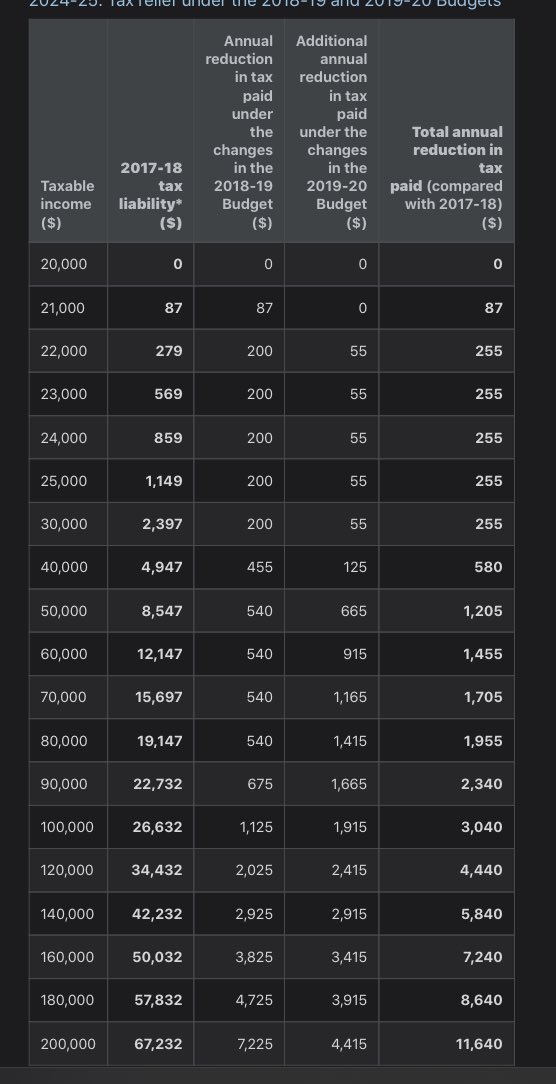

When in doubt, cut taxes — because if you want those in the middle to stop yapping on about the treatment of those on lower incomes, hope a $1500 tax cut will buy five minutes quiet about the inherent injustice of our stratified economy:

Failing Upward

Where I recognise and celebrate the true stupidity of the rich, powerful and influential…

In a development that could not more perfectly justify the conceit of Failing Upward, we here at Raising Hell have this fortnight decided to recognise the fine form of federal Aged Care Minister Richard Colbeck. During a senate inquiry hearing, Colbeck — the man whose alleged job is to look after the system that looks after your nan — took a very long half minute to find the bodycount left by Covid-19 in Victorian aged care homes during the pandemic:

A couple of days later, Colbeck was still helplessly sliding down the learning curve. Appearing on the floor of parliament, he simply couldn’t get the number right (335, at the time) despite it being repeated in front of him moments before. Later, when he was forced to apologise for certain “missteps”, Colbeck walked out before anyone could ask him any follow up questions. Defending himself to reporters later, Colbeck said he had left to speak to aged care providers about testing for staff and claimed the perfectly natural reaction to gross negligence was all just political theatrics by Labor.

Rest assured, Colbeck insists he has the full support of the Prime Minister, will continue to enjoy his six figure salary and presumably cushy retirement — just probably not in a state-run aged care facility.

Good Reads, Good Times

To share the love, here are some of the best or more interesting reads from the last fortnight…

- Among the tidal wave of books to be published this September is Marian Wilkinson who just released The Carbon Club outlining how the Coalition have worked hard to ensure we’re living in a slow-cooking hellscape. Excerpt via The Sydney Morning Herald.

- Closer to home, South Australian author, Kylie Maslen has her debut book, Show Me Where It Hurts, out now through Text Publishing, as does Katarina Bryant who blends memoir and historical analysis to track how women have been mistreated by medical workers in Hysteria. They are also joined by renowned poet of everyday life Geoff Goodfellow who has released a new memoir Out of Copley Street.

Before You Go (Go)…

- Are you a public sector bureaucrat whose tyrannical boss is behaving badly? Have you recently come into possession of documents showing some rich guy is trying to move their ill-gotten-gains to Curacao? Did you take a low-paying job with an evil corporation registered in Delaware that turns out to be burying toxic waste beneath children’s playgrounds? If your conscience is keeping you up at night, or you’d just plain like to see some wrong-doers cast into the sea, we here at Raising Hell can suggest a course of action: leak! [NOTE: In the past I’ve used Wickr but I’m now in the process of switching to another platform, so check back in a few weeks.]

- If you’re lurking and like what you see, throw me a subscription to get my screeds straight to your inbox every second Tuesday — it’s free. If you like what I do and want to see me do more of it, throw me a paid subscription — it’s $5 a month or $50 a year. Are you skint? Or flush? Well, you can also pay what you feel I’m worth by setting your own yearly rate.

- And if you’ve come this far, consider supporting me further by picking up one of my books, or leaving a review or just tell a friend about Raising Hell!