Raising Hell: Issue 9: Hot World, Cold Calculations

"I'm getting out to mind my own fucking business, from somewhere else, and so I'm leaving this shitty country, of which I'm sickened." - Italian Prime Minister Silvio Berlusconi on Italy, 2011.

Last Friday, as much of the country was focused on the news coming out of Victoria, a group of men in suits from Australia’s biggest insurance providers were meeting to discuss the end of the world with the even-handed tenor associated with corporate boardrooms everywhere.

The scene from the Senate Finance and Public Administration References Committee — streamed online — lacked the spectacle of Victoria’s wealthiest citizens attempting to flee a second wave of Covid-19 by booking it for the border or bugging out to their second homes in the countryside. The senate committee — that had ostensibly been running its own investigation looking at the Black Summer Bushfires — got off to a slow start. The first half an hour or so was all formalities and logistics before a brief interlude from Liberal Senator James Patterson, who took a chance to ask several leading questions of representatives from the four biggest companies in the Australian insurance industry about the potential for tax-cuts to help with the bushfire’s aftermath.

At the first question about climate change, the figures from Allianz, QBE insurance, Suncorp and Insurance Australia Group (IAG) began to grow visibly uncomfortable. As a subject, climate change was one they preferred not to talk about in public. With a few notable exceptions, the eery silence from the masters of risk had continued all the way up through last decade until the bushfires raged. At that point the grey-wall of silence became hard to maintain as the cost of more extreme weather events began to show up on their books. The first three months of 2020 alone cost the industry as a whole $5.3 billion in payouts from the combined impact of “secondary perils” like fire, flood and hailstorms.

When the industry has spoken about climate change in public, the tactic has largely been to reframe the conversation around highly specific and less emotive phraseology like “premium affordability”. As a rhetorical device, this was clever in that it allowed the industry to continue its fence-sitting even though they were already to feel its consequence. Between them, the companies represented at the senate committee hearing had lost a combined $721 million from the first quarter of 2020.

Oddly enough this is because the financial world doubles as the medium through which the long-arc of climate change acts on human affairs. If the balance of debt and risk might decide whether a farmer will stay on the land or seek more stable work in the city after a massive bushfire or drought, climate change works by spreading the pain to a whole new scale. As weather events become more unstable and extreme, the inability to buy insurance and the sizable debts needed to finance farmings operations have the potential to empty out entire regions. In real terms, that’s the kind of thing that in the long run makes it difficult to reliably feed 26 million people.

While this may seem like hyperbole, it has a basis in the Insurance Council of Australia’s (ICA) own submission to the committee that summed up the situation in stark terms. At page 10, the industry body painted a terrifying vision of the future where the landscape was wracked by bushfires, floods, drought and power outages as the machinery built to operate in external environments broke down under heat stress:

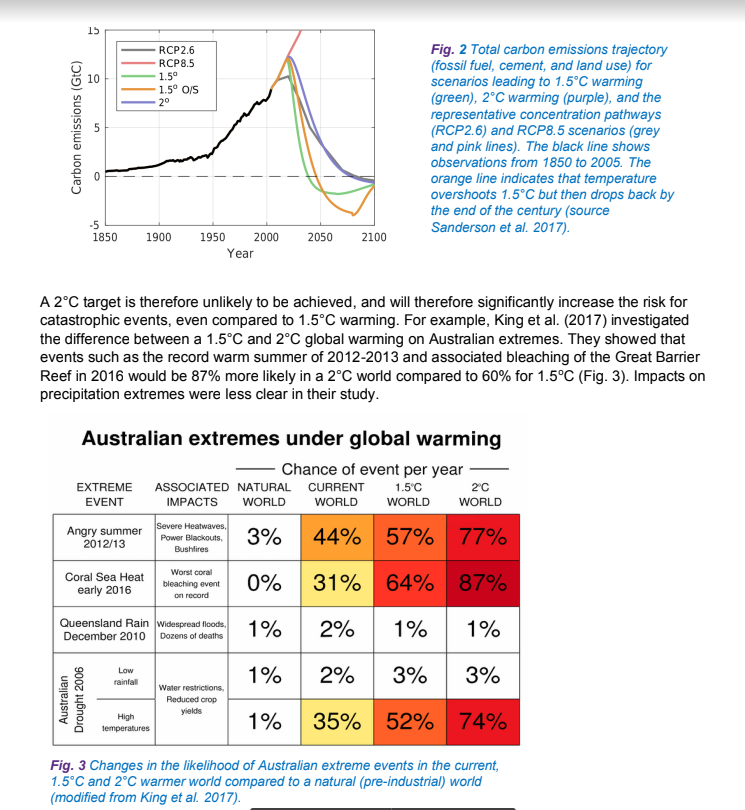

Translated from statistician into plain English, the ICA was essentially saying that the chance any government, anywhere in the world was going to do anything meaningful to address the root cause of climate change was now slim to none. At the same time, the clockwork nature of the seasons was already beginning to break down, making them more difficult to read with certainty. In a world where average temperatures were 2 degrees hotter — the most likely future we will inherit according to the ICA — walls of flame and biblical-scale flooding were nearly twice as likely to occur in any given year.

The significance of this cannot be understated. This wasn’t some NGO or an environmental activist group — the people saying this were the very nerds who were so insanely good at math they had been charged with overseeing a central financial organ of the Australia economy.

This is why it was somewhat unnerving when the industry figures spent their time before the senate committee ducking questions, often to comedic effect. The unease with which they gave plain answers invariably led to a series of absurd exchanges as they attempted to explain how we needed to focus now on “mitigation” given the total absence of meaningful action from government.

When committee chair, Labor senator Tim Ayres pointed out the obvious — that focussing on mitigation was like putting a bandaide over a bullet wound — the response was strange. Luke Gallagher and Mark Leplastrier from Insurance Australia Group responded with an excited, minutes-long explanation about the potential of new technologies — such as fire retardant gels for use in firefighting — to help control future bushfires and in turn lower insurance premiums. The little moment may have been insignificant in the scheme of things, but what it showed was the extent to which these guys were plainly pinning their hopes to some kind of technological Deus ex machina fix for climate change at the last possible second.

Picking up on this, Ayres tried again, once more highlighting the obvious: at some, point slathering ourselves in fire retardant gel was not a feasible strategy to counter climate change — especially as it reached a tipping point where the impact outstripped mitigation and especially given the industry was already feeling massive financial pain.

To this, Allianz' Chief corporate affairs officer Nicholas Schofield responded by confirming the first three months of 2020 were “certainly the most costly I can recall” before again attempting to reframe the issue into one more politically conducive to pushing for tax cuts.

“I think the way we look at it is more in terms of: what’s the issue for our customers now in terms of insurance affordability?” Schofield said. “And you talked about climate change overtaking mitigation and whether parts of Australia will become uninsurable if the premiums become so high. We would argue at Allianz that we’re here now with issues about affordability.”

The outright weirdness of this exchange was perhaps only eclipsed by another towards the break when Phuong Ly, chief underwriting officer for QBE Insurance, was asked point blank what his company had been doing to address the issue of climate change. The faithful CUO helpfully outlined the ways his company were working to become carbon neutral. It was, perhaps, a safe way of saying “nothing”.

Through it all, none of the industry figures had given any straight answers on any of the questions that mattered: How much would premiums rise in the face of runaway climate change? Why hadn’t weren’t they talking to government about the massive financial risk? And most importantly: why had they done nothing meaningful?

The only thing resembling an answer would come after the break when Rob Wheelan, outgoing CEO of Insurance Council of Australia (ICA), appeared. Back in early July, an interview with Wheelan was published in Insurance News where he said the single biggest regret of his career was not having “done more on climate change.”

“It’s a delicate balance with the political environment that you are working with, because there were very strong views within the Government at various times that this was not an issue, and that we needed to keep out of it,” Wheelan said. “While we always maintained the view that [climate change] is an important material risk, the extent to which we could be vocal about this was somewhat limited.”

Wheelan was referring specifically to that period in the 20-teens when figures like Tony Abbott were stomping around, tearing up any piece of legislation or policy that may have assisted in the transition to a zero carbon economy.

When the ICA chief was asked who, exactly, had suggested the industry “needed to keep out of it”, Wheelan denied any explicit warning had been given. Rather, the nation’s insurers had read the room, seen the bitter fight taking place in public and decided it was all a bit much.

“From my point of view, I had to make sure that I was representing the industry as best as possible throughout those years and also being able to provide information in an agnostic way that decision makers and policymakers can judge for themselves and make the appropriate decisions,” Wheelan said. “So I’m not a policymaker in that sense. I’m not a lawmaker, but I can provide through the industry information and a view. If you go back to my article, my regret is that I wasn’t as forceful as I should be.”

“Agnosticism” was perhaps a poor choice of words for an industry which was supposed to have understood what climate change meant before most — though apparently not in Australia. As the Australian Financial Review reported in early March, when Swiss Re — the insurers who insure the insurers — checked in, they found Australian insurance companies had consistently failed to predict the cost of bushfires, hailstorms and extreme rain events. In particular, the models IAG had been using were so painfully wrong, it had not only burned through the spare cash it kept around to cover it case of a disaster, but it had drawn on its catastrophe allowance reinsurance protections in their entirety — and that still wasn’t enough to cover the loss.

If fence-sitting had largely kept the insurers from having their feelings hurt, for the average person it represented a tragedy. As Wheelan explained during the hearing, if the industry wasn’t necessarily out in the world talking about the real, tangible cost of climate change, its “blunt” method for communicating the message was to jack up prices over time. In other words, all the risk and associated costs of climate change were quietly being passed onto the average person — a dynamic the insurers were pretty clear about. When Allianz’ Nicholas Schofield was asked during the committee hearing whether his shareholders may have concerns about the devastating financial impacts of climate change, his answer could be paraphrased as: not really.

“Ultimately, whether it’s taxes or reinsurance price rises or our own premium adjustments relating to claims experienced from weather events, its only customers that can pay,” Schofield said. “The customer bears it at the end of the day.”

In other words, no matter how bad things may get, the insurers or their accountants certainly weren’t going to be left holding the bag. And if past performance was any indication of future performance, the behaviour of wealthy Melbournites during the pandemic suggested these guys would certainly be tapping out the moment things went south.

And at that point, we would really be on our own.

Reporting In

Where I recap what I’ve been doing this last fortnight so you know I’m not just using your money to stimulate the local economy …

- ‘Public schools still missing out on funding’ (2020, The Saturday Paper, 11 July).Much of my work this last fortnight has been back of house as I cook up a few big features and investigative projects. Still, I managed pull together this look at how funding for private schools continues to outstrip that for public schools for last Saturday’s paper.

- ‘The flaws in the COVIDSafe app’ (2020, The Saturday Paper, 4 July).The other project I have spent a bit of time on is following the evolving saga of the government’s COVDSafe contact tracing app. Here I retell the story about how a bunch of tech people, working independently at first but then as a team, pulled apart the program to discover just how flawed it truly was.

- Book NewsWith my next book Just Money out in September through UQP, you’re going to be hearing me talk a lot about it over the coming months — so consider this an apology in advance. The way I figure it, if I don’t promote it, no one else is going to do it for me. I’m also planning a launch, so I will keep you all posted.

- FOI NewsIn the process of doing the story for The Saturday Paper, a series of questions arose about what exactly the contractors who worked on the COVIDSafe app were doing with all that public money. Thanks to the support of my generous subscribers, I was able to put aside Monday last week to fire off a series of Freedom of Information requests related to the COVIDSafe tracking app. The DTA has already requested a 30 day extension on two out of three applications, so I’ll update you in two months.

You Hate To See It

A dyspeptic, snark-ridden and highly ironic round-up of the news from our shared hellscape…

It’s The End Of The World As We Know It (And I feel fine)

Australia’s top scientists are once more warning that with the trajectory we are currently on, the most likely outcome for humanity is a headlong dash into the collapse of civilisation. For context, it is worth pointing out humans have had plenty of warning about the consequence of burning fossil fuels given newspapers in 1912 predicted climate change before it was a thing and we as a species met the news with a collective shrug. Go team!

This… Is SAPOL’s Boomstick.

In a pitch-perfect read of the current mood, the South Australian Police (SAPOL) unveiled the new special response section (SRS), a paramilitary-like organisation half-way between regular beat-cop and Star Group tactical response unit. The purpose of the unit is to be present at large public gatherings where there is risk of a “lone hostile actor” or a “vehicle incursion” as part of a terrorist incident — which occur frequently in Adelaide. To promote the initiative, officers from the SRS patrolled Rundle Mall and the Central Markets carrying assault rifle to show the general public how safe they were. The imagery was received about as well as you might expect.

Rising Tides And Lopping Fingers

Police in the Netherlands raided a series of industrial cargo containers on the Dutch-Belgium border to find a fully equipped, sound-proofed torture chamber (complete with garden shears and loppers) and six accompanying prison cells. The set up appears to be a premium package offered to a high-end clientele through encrypted instant messaging service EncroChat — home to a lively 60,000-strong marketplace that connects high-risk traders to the specialist service providers who cater to them.

The Hamptons Is Not A Defensible Position

Wealthy Melbournites looking to flee take note, rich New Yorkers who bailed to the perceived safety of the Hamptons at the start of the pandemic are growing confused and increasingly worried by the enduring anger directed at them from pissed off locals. After a spate of protests targeted figures like failed Democratic presidential contender Mike Bloomberg, real estate mogul Stephen Ross and Blackstone CEO Steven Schwarzmann who all have second homes in the idyllic community, members of the American oligarchy have taken to hiring private security to protect their holiday homes against protesters they describe, simply, as “crazy”.

RE: Synergistic Omni Channel Experiences In Vertically Integrated Ecologies

In the enduring quest to run the Australian government like a business, it has been revealed $230,000 has been flushed bringing in US management consulting firm “People Rocket” to provide “innovationish” training. The company claims it helps improve traditional management cultures by replacing them with “cultures that champion innovation through cross-functional collaboration”. What is Innovation Training? Well, according to a company spokesperson it is: “A mindsets-first approach (to innovation): to gain access to, and continued use of, a learning and experiential engagement pedagogy for developing and/or accelerating innovative mindsets, and strategic innovation change management.”

Stuart Robert: Simple, Helpful, Respectful, Transparent

Of late, Minister for government services Stuart Robert seems to be reimagining his role as some mix of visionary tech CEO and evangelist preacher. Reading the transcript of his recent appearance at the National Press Club in Canberra with this in mind, a few Robertisms in his speech and following QandA really stood out:

“Ronald Reagan famously quipped that the most terrifying words in the English language are ‘I'm from the government and I'm here to help.’ […] What if those words weren’t terrifying? What if they were true? What if Government not only helped, but helped in a delightful manner?"

“As I tell my executives: if service is beneath you, then leadership is beyond you.”

“It has not been an ordinary 12 months and it has been an extraordinary six months.”

“Were there mistakes? Yes. Plenty of them, but we only made them once and when we failed, we failed fast and tried again.”

“Government is not geared to do refunds.”

“So, we — once issues happen, we move very fast to resolve them and fix them within days”

Responding to a question about plans to introduce facial recognition technology as an authentication method for accessing government services: “And then you have won't fear [sic] about any of your credentials being stolen from yourself, from your own phone, from your computer, and appearing on the dark web, because it's very difficult to steal your face, isn't it, Tim? A face we well-recognise and love.”

Image: Tim Shaw, radio presenter and national director of the Canberra Press Club — and his aforementioned face. (Source: National Press Club)

Failing Upward

Where I recognise and celebrate the true stupidity of the rich, powerful and influential…

Given these trying times, we here at Raising Hell decided to make good on our civic responsibility, do away with the snark and instead direct our subscribers attention to this video of Greg Hunt. In a helpful public service announcement, the federal health minister demonstrated how to put on a mask. We are comforted knowing our fate rests in capable hands. Stay safe.

Video from today's coronavirus press conference shows Health Minister @GregHuntMP struggling to fit himself with a face mask.

— 7NEWS Australia (@7NewsAustralia) 3:34 AM ∙ Jul 13, 2020

Latest news on face masks: 7news.link/2Wcwviw #7NEWS

Good Reads, Good Times

To share the love, here are some of the best or more interesting reads from the last fortnight…

For the curious, Walter Marsh (an editor of mine and a subscriber to this newsletter) at The Adelaide Review pulled all the background he could on SAPOL’s new squad and their shiny-new assault rifles.

Liz Flux (a subscriber to this newsletter) has this in Kill Your Darlings reacting to events in Hong Kong.

This long-format interview in Liminal with a Japanese camera-repairman in Melbourne offers a window into the life of Hiroyoshi Nagami, an ordinary guy with ordinary concerns who has repaired 50,000 cameras and has a few life lessons to share.

As a sucker for archaeology news, this longread in The New Yorker about the politics of searching for King David’s lost empire had all the best elements of a mystery and a cogent political analysis.

Looking for a reading list of black authors after the recent protests? Maybe don’t just focus on those talking about the trauma of being black in a society built for white people and pick up those whose writing has been overlooked.

Branko Milanovic, an expert on global inequality, has this summing why rich people prefer lower taxes to actually doing The Work.

The fact is that for the rich it makes much more sense to engage in lobbying to reduce taxes than to bother with trying to grow their countries. The gains are much greater and immediate if they do the former. And obviously they do it.

— Branko Milanovic (@BrankoMilan) 6:03 AM ∙ Jul 11, 2020

Before You Go (Go)…

Are you a public sector bureaucrat whose tyrannical boss is behaving badly? Have you recently come into possession of documents showing some rich guy is trying to move their ill-gotten-gains to Curacao? Did you take a low-paying job with an evil corporation registered in Delaware that turns out to be burying toxic waste beneath children’s playgrounds? If your conscience is keeping you up at night, or you’d just plain like to see some wrong-doers cast into the sea, we here at Raising Hell can suggest a course of action: leak! Download the encrypted message app Wickr Me onto your phone or laptop and contact us securely at my handle: rorok1990.

If you’re lurking and like what you see, throw me a subscription to get my screeds straight to your inbox every second Tuesday — it’s free. If you like what I do and want to see me do more of it, throw me a paid subscription — it’s $5 a month or $50 a year. Are you skint? Or flush? Well, you can also pay what you feel I’m worth by setting your own yearly rate.

And if you’ve come this far, consider supporting me further by picking up one of my books, or leaving a review or just tell a friend about Raising Hell!